new mexico gross receipts tax rate

Under the current gross receipts tax rate of 83125 percent in Las Cruces the tax on the current ticket price would amount to 37406 which the. The tax base and allowable expenditures vary depending on the design of the gross receipts tax.

New Mexico Sales Tax Small Business Guide Truic

Combined with the state sales tax the highest sales tax rate in New Mexico is.

. But service businesses pay a 15 rate. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. A proposal that would have taxed passenger tickets to space with Virgin Galactic was tabled by a New Mexico legislative committee Monday afternoon effectively scuttling the bill for the current 30-day session.

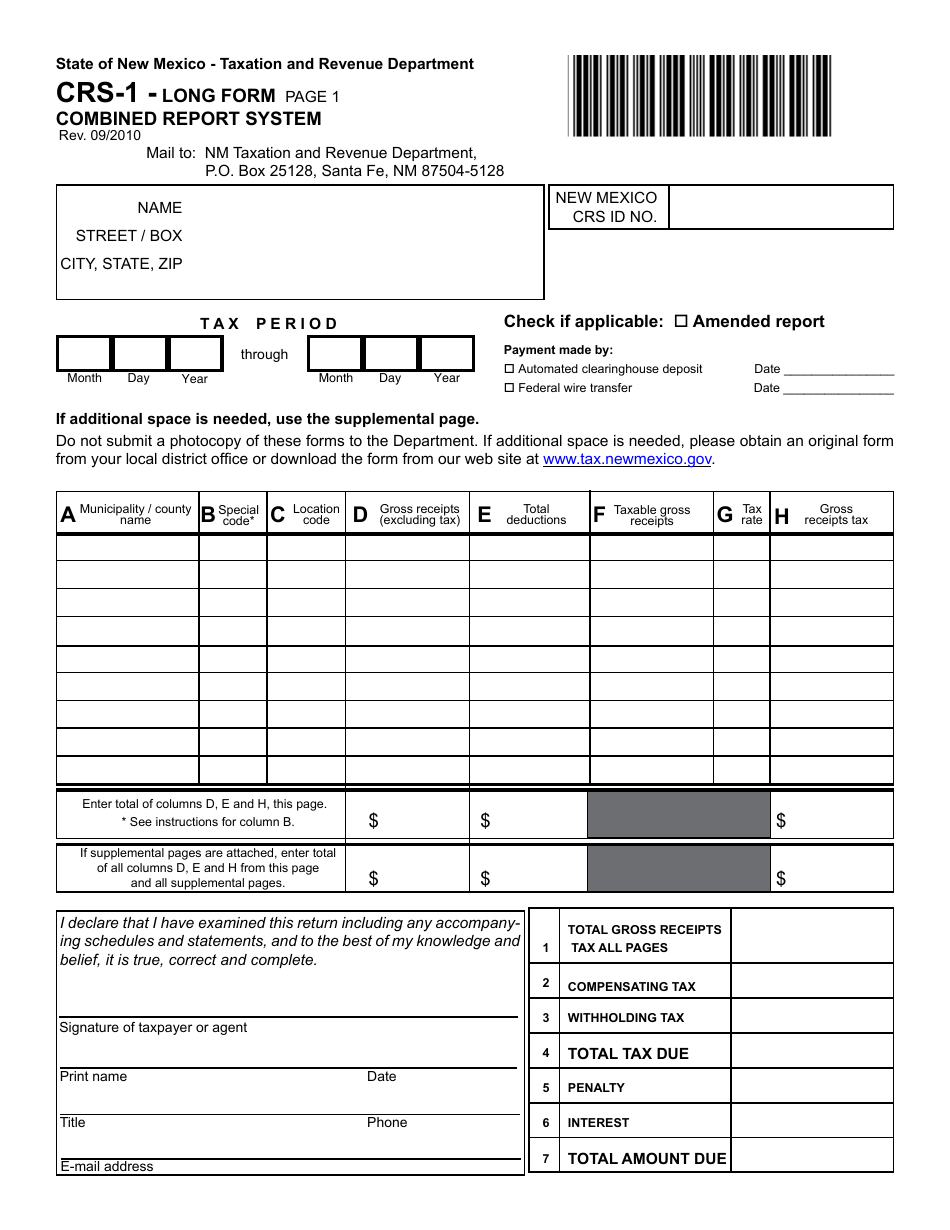

Use this page if additional space is needed to report gross receipts from multiple locations. The measure passed by the New Mexico Legislature and enthusiastically signed by Gov. The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent.

Attach this page to the Form TRD-41413. New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125There are a total of 134 local tax jurisdictions across the state collecting an average local tax of 2257. The tax relief bill also would give 1000 credits to full-time local hospital nurses for the 2022 tax year and slightly reduce the state gross receipts tax.

What is Gross Receipts Tax Gross receipts means the total amount of money or the value of other consideration received from selling property in New Mexico leasing or licensing property employed in New Mexico from. Ohio and Oregon have flat rates of 026 percent and 057 percent respectively. January 23 2022 GMT.

In general the gross receipts tax rate is origin-based determined by the business location of the seller or lessor not the location of the buyer or lessee. 100000 of taxable gross receipts sourced to New Mexico in the previous calendar year. The business pays the total Gross Receipts Tax to the state which then distributes the counties and municipalities portions to them.

Businesses at each stage will only see the statutory rate and will not see that the price is higher than it would be otherwise due to the tax levied at the earlier production stages. 72 would have clarified an existing tax law excluding receipts from launching operating or recovering space vehicles or payloads in New Mexico from gross. Washingtons Business and Occupation Tax has the highest top rate of 33 percent followed by Delawares Manufacturers and Merchants License Tax with a top rate of 19914 percent.

Commonly the percentage runs about 5 or half a percent. New Mexico tax law unintentionally cuts into city revenues. Mechnically you simply pay a percentage of your gross receipts.

And some businesses pay lower rates. This tax is imposed on persons engaged in business in New Mexico. In almost every case the person engaged in business passes the tax to the consumer either separately stated or as part of the selling price.

New Mexico Hawaii North Dakota. See What is Gross Receipts Tax below for more information. Enter the total amount of gross receipts tax due here.

Consumers will face higher. For example a 05 percent statutory tax rate on gross receipts could pyramid to an effective tax rate of 125 percent see Table 2. The gross receipts tax rate varies throughout the state from 5125 to 88675.

Tax Rate Gross Receipts Tax Due Enter the total amount of gross receipts excluding tax here. Click here for a larger sales tax map or here for a sales tax table. Only in its effect on the buyer does the gross receipts tax resemble a sales tax.

Anything over 5125 percent represents local option rates imposed by counties and municipalities. Page _____ of _____ New Mexico Business Tax Identification Number - NMBTIN Print Tax Period. Click here to see the Department of Revenues current list of business and occupation tax rates.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. AP The city of Hobbs is pushing to amend a state law that city officials say is resulting in an unintended loss of gross receipts tax revenue for the community.

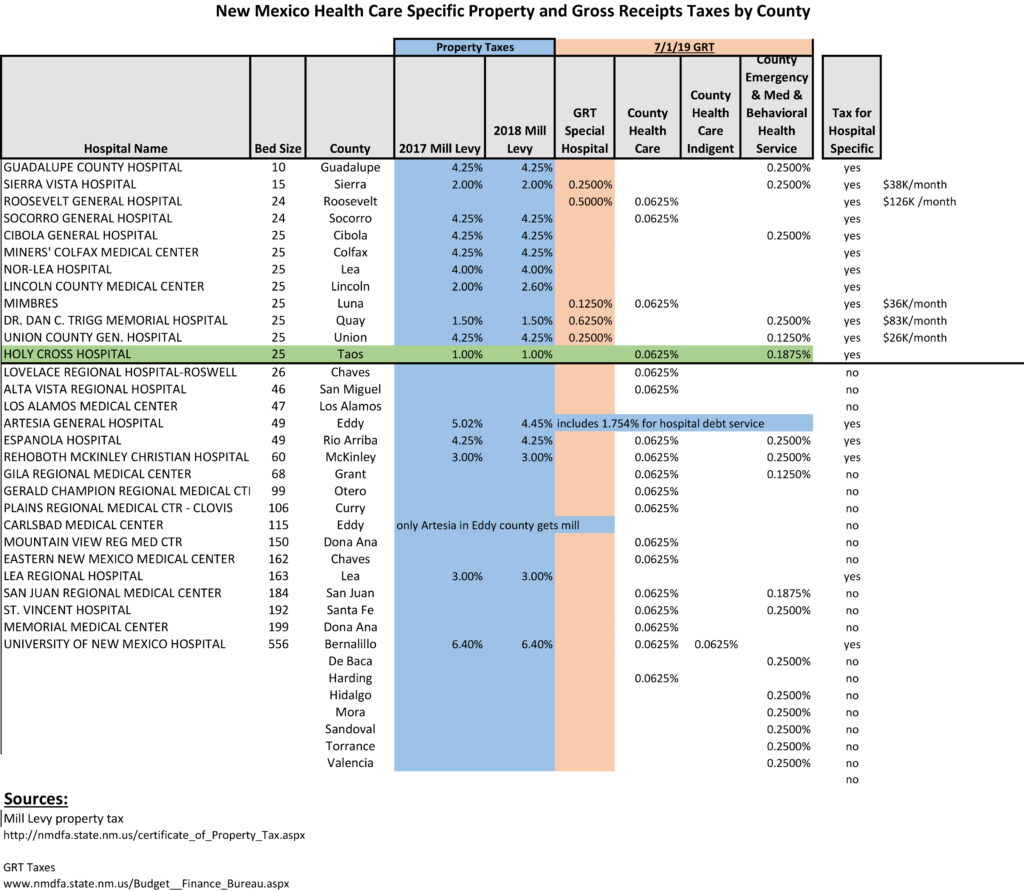

Property And Gross Receipts Taxes By County Holy Cross Medical Center

What Is Gross Receipts Tax Overview States With Grt More

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

New Mexico Grt Rate Maps Taos County Association Of Realtors

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

Nm Tax Law Update Destination Based Sourcing And Gross Receipts Taxes Part 1 Youtube

Greater Gallup Economic Development Corporation Taxes

State S Gross Receipts Tax It S Complicated Resource Tool For Start Up And Small Businesses In New Mexico

Gross Receipts Location Code And Tax Rate Map Governments

Form Rates Fillable 2014 Gross Receipts Tax Rate Schedule January To June