north carolina estate tax exemption 2019

NC Gen Stat 131A-21 2019 131A-21. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in the 2017 Tax Act.

North Carolina Gift Tax All You Need To Know

As of 2021 the exemption sits at 2193 million and the top tax rate is 20.

. NCDOR Issues Update on Opening of 2022 Tax Season. Raleigh NC 27601 919 733-4111 Main 919 715-7586 Fax. That limit is the applicable lifetime gift and estate tax exemption when you pass away.

2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21 - Tax exemption. All of the bonds and notes authorized by this Chapter shall be exempt from all State county and municipal taxation or assessment direct or indirect general. 28A-27-2 to the extent of the allowable.

If an estate is worth 15 million 36 million is taxed at 40 percent. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Multiply the annualized taxable wages calculated in step 6 by 535 percent to determine the annual tax amount.

North Carolina General Assembly. Individual income tax refund inquiries. Determine the exemption allowance by subtracting the amount from the gross annual wages to compute the taxable income.

NC Gen Stat 159I-23 2019 159I-23. Streamlined Sales and Use Tax Agreement Certificate of Exemption Form. Divide the annual North Carolina tax withholding calculated in step 7 by the number of.

The estate tax exemption is the amount a. The Internal Revenue Service announced today the official estate and gift tax limits for 2019. Of course the current lifetime exemption is very high compared to historic levels.

16 West Jones Street. PO Box 25000 Raleigh NC 27640-0640. First the states 2 million exemption was indexed for inflation on an annual basis.

Prepare your 2019 North Carolina return for 1799. If you are totally and permanently disabled or age 65 and over and you make. The exemption will be phased in as follows.

Strict compliance is necessary in order for property to be properly exempted or excluded from taxation. The Budget Bill was ratified in June and presented to the Governor. Every owner claiming exemption or exclusion has the burden of establishment that the property is entitled to such preferential treatment.

The estate and gift tax exemption is 114 million per individual up. This bill will annually increase the states estate tax exemption until it matches the federal estate tax exemption of 117 million in 2023. North carolina department of revenue.

Finally certain family-owned businesses received an estate tax exemption of up to 25 million. 26 rows What is the North Carolina estate tax exemption. Exemption Allowance 2500.

Individuals effectively shield 1206 million for 2022 or 117 million for 2021 from estate taxes assuming they never breached an annual gift tax exclusion in their lifetime. This Alert summarizes the more significant tax provisions enacted by the North Carolina General Assembly in 2019. As of January 1st of the year for which.

If you qualify you can receive an exclusion of the taxable value of your residence of either 25000 or 50 whichever is greater. The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. North Carolina General Statute 105-2821 governs applications for exemption or exclusion.

The estate tax exemption was then increased in 200000 increments to reach 3 million in 2020. A Any interest for which a deduction or exemption is allowed under the federal revenue laws in determining the value of the decedent s net taxable estate such as property passing to or in trust for a surviving spouse and gifts or devises for charitable public or similar purposes shall not be included in the computation provided for in GS. This delay is due to the late approval of the state budget in November 2021 which included multiple tax law changes.

Qualifying owners must apply with the Assessors Office between January 1st and June 1st. Delaware repealed its estate tax in 2018. 2019 North Carolina General Statutes Chapter 159I - Solid Waste Management Loan Program and Local Government Special Obligation.

Homeowners age 65 or older whose spouse is deceased can exempt up to 60000 under the homestead exemption if the property was previously owned by. The exercise of the powers granted by this Chapter will be in all respects for the benefit of the people of the State and will promote their health and. North Carolina Department of Revenue.

Then the estate tax rates for the top four brackets increased by one percentage point. Up to 25 cash back Under the North Carolina exemption system homeowners can exempt up to 35000 of their home or other real or personal property covered by the homestead exemption. Individual income tax refund inquiries.

Free prior year federal preparation Prepare your 2019 state tax 1799. Ad Free prior year federal preparation. Estate and inheritance taxes are burdensome.

Department of Revenue is targeting the week of Feb. 5520 sharon view rd charlotte north carolina 28226. North Carolina allows low-income homestead exclusions for qualifying individuals.

28 to open state tax season with refunds going out in early April. A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

The most important tax changes were originally included in House Bill 966 the 2019 Appropriations Act the Budget Bill. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025.

How To Handle A Small Estate In North Carolina

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Special Proceedings To Sell Real Property Hopler Wilms Hanna

Flexjobs Remote Work Virtual Job Fair Reserve Your Spot Virtual Jobs Job Fair Work From Home Jobs

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Tax Administration Duplin County Nc Duplin County Nc

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Thank You For The Outstanding Service Going Above And Beyond This Company Was And Still Is A Fantast Above And Beyond Customer Experience Santa Clara County

North Carolina Tax Reform North Carolina Tax Competitiveness

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

135 Stillwater Rd Troutman Nc 28166 Realtor Com

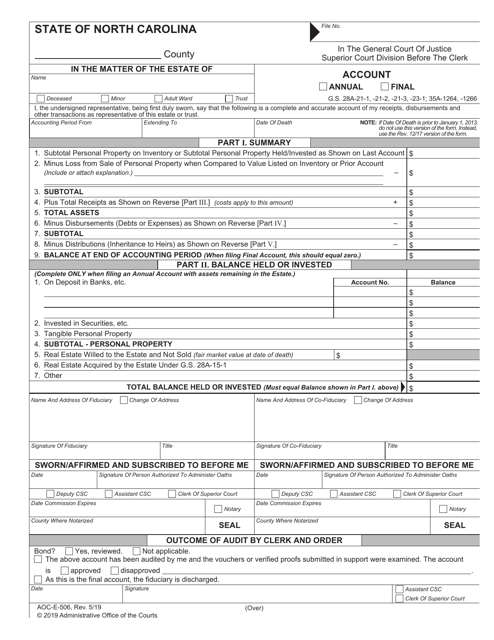

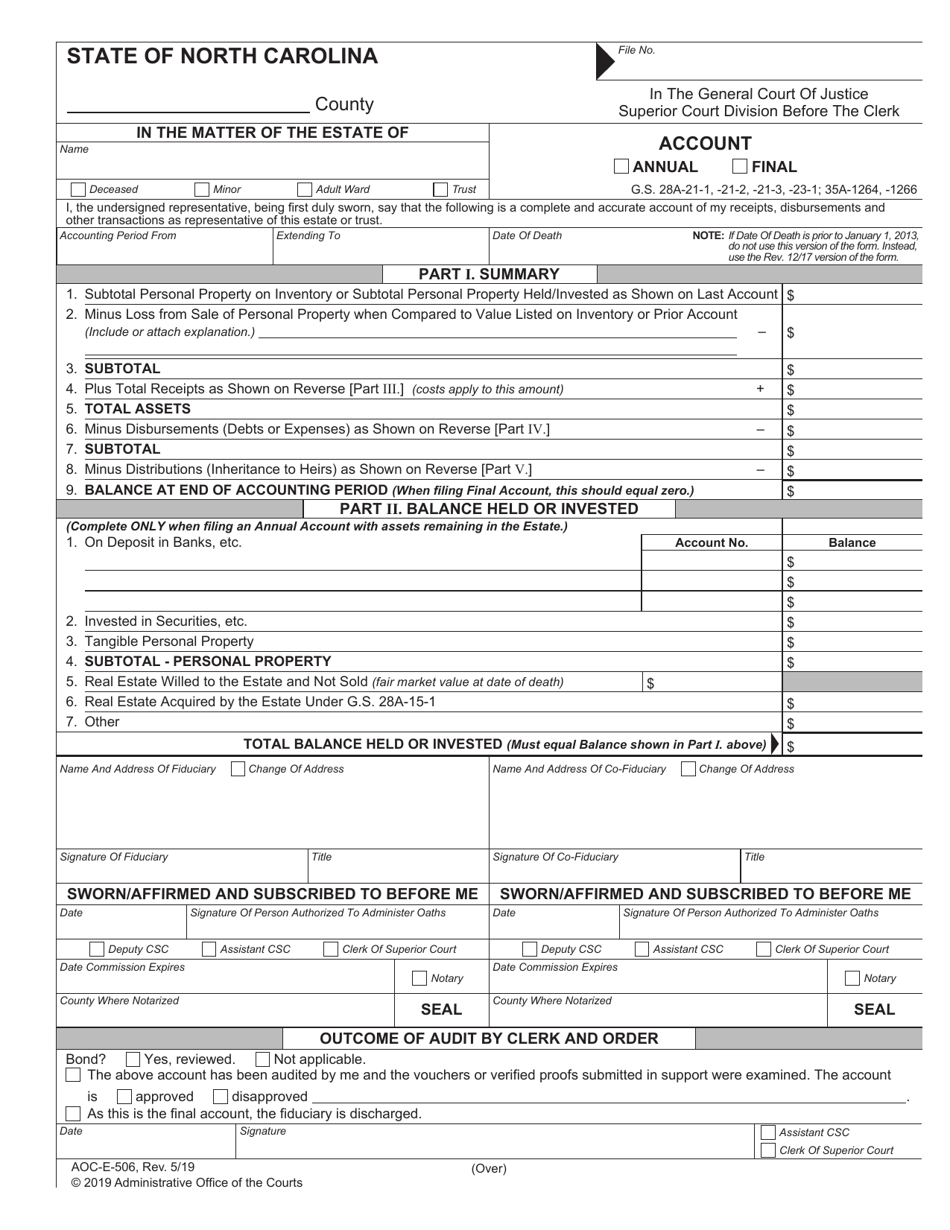

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

A Guide To North Carolina Inheritance Laws

Highlights Of North Carolina S Tax Changes

Frequently Asked Questions Carolina Tax Trusts Estates

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

North Carolina Tax Reform North Carolina Tax Competitiveness